EasyBuild

EasyBuild is the perfect solution for home builders.

Our new construction program is incredibly easy to navigate and we want you to succeed by making the process incredibly straightforward and easy.

I want to share an opportunity that could be a great fit for you. EasyBuild is the most reliable and straightforward construction loan program available for multi-unit townhome and condo projects. It’s designed to help builders like you move quickly and take full advantage of today’s market opportunities.

Whether you’re scaling up or just starting out, EasyBuild gives you flexible financing and a smooth process so you can focus on building, not worrying about funding. With the right financing in place, you’ll be positioned to maximize returns and grow with confidence.

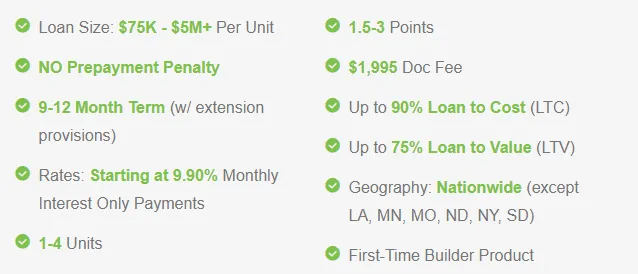

Program Terms

Commercial Loans Florida provides hard money construction loans for developers building residential properties. Our New Construction Program is the perfect fit if you’re tearing down an existing home to build new or purchasing a lot to start fresh.

With any construction project, having a reliable and timely financing partner is critical. At Commercial Loans Florida, we pride ourselves on delivering exceptional service to our borrowers, ensuring that construction draws are processed within 48–72 hours. Keeping your contractors paid on time is essential to keeping your project on track — and we make that a priority.

Commercial Loans Florida looks forward to being your trusted financing partner on your next construction project.

Testimonials

Commercial Loans Florida made the financing process effortless. From application to funding, everything moved quickly, and the draw requests were processed within days. Having such a reliable partner kept my project on schedule and my contractors paid on time. I couldn’t have asked for a smoother experience.

Joseph B - Aug 2025

Working with Commercial Loans Florida has been a delight. Their team is knowledgeable, responsive, and always available to answer questions. They truly understand the needs of developers and made the financing side of my project stress-free. I’ll definitely be coming back for my next build.

Teresa Campos - Jan 2025

I was amazed at how simple the process was with Commercial Loans Florida. The loan program was straightforward, and the team guided me through every step. It gave me the confidence to move forward quickly, knowing I had a dependable partner behind me. Fast service, excellent communication, and a great experience overall.

Jim Thorn - Dec 2024

© 2025 Commercial Loans Florida, Inc. - All Rights Reserved.

727-642-1166

This website is intended to provide information regarding Business Purpose Loans, which are non-TRID (TILA-RESPA Integrated Disclosure) loan programs designed to support the financing needs of businesses. Business Purpose Loans are designed strictly for business, commercial, or investment purposes. These loans are not intended for personal, family, or household use. If you are seeking financing for personal use, we recommend you explore other loan options. Terms and eligibility for Business Purpose Loans may vary based on individual qualifications, loan type, and property use. Loans for business purposes may be secured by various types of properties, including residential, multi-family, commercial, or mixed-use properties, as long as the primary use of the loan is for business purposes. It is important to understand that, as part of the loan agreement, the collateral may be subject to foreclosure if the borrower defaults. The information provided on this website is for informational purposes only and does not constitute an offer to lend, a loan approval, or a guarantee of financing. All loan programs are subject to underwriting approval, and the terms, rates, and availability of loan programs may change without notice. We encourage all borrowers to seek professional legal, financial, or tax advice before entering into any loan agreement. Business Purpose Loans can have significant financial implications, and it is important to understand your obligations and rights fully before proceeding with any loan.